Cashflow planning, forecasting is done through state-of-the art algorithms and automated data discovery techniques that analyze your historical data, find patterns, outliers, anomalies, relationship between various variables.

A machine learning driven engine gives you a precise vision on what will affect your Cash Flow position and by how much. The traditional way to build a forecast is labor intensive, and it doesn’t fit in today’s business culture where teams are expected to do more with fewer resources.

Predictive analytics solves this problem by digitizing and speeding up many of the tasks that are involved in planning your company’s cash requirements. We analyze trends in overall cashflow as well as patterns behind counterparty behavior.

iNatrix In-Built Cashflow Predictive Model

Discovery questions –

- Is there a pattern in a counterparty’s payment behavior that we can mine from historical data?

- Is it possible to estimate and forecast if an invoice will be paid on time or not?

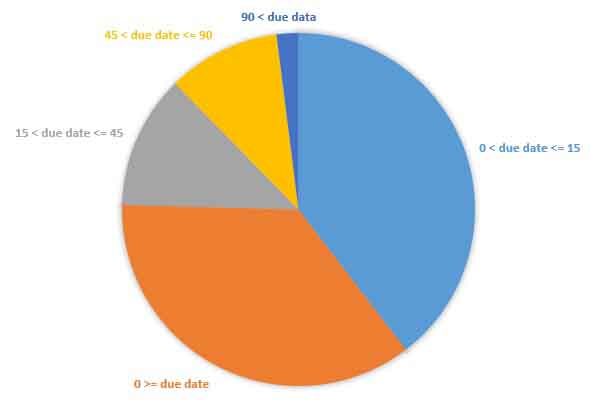

The output of the model is the time period in which an open invoice is expected to be paid, such as before the invoice due date or within 15 days after due date. Users specify custom time periods as predefined input. The figure below shows an example of aggregated output of the model.

Model output

iNatrix’s financial analytics model provides these benefits:

- Predicting upcoming cash surpluses and shortages to enable commodities companies to make better, fact-based decisions around potential investments or borrowing opportunities.

- Improving collection management by highlighting invoices that are expected to have a significant delay so that the commodity company can take preventive measures to facilitate timely payment (such as following up with the customer immediately).

- Predict late payment of invoices by predictive analytics of counterparties

- Identifying parameters that determine invoice payment behavior.

- Business intelligence benefits such as real time analytics on Cash flow, Secondary Cost Analytics, Capex, Account Payable and Receivable.

Integrating enterprise systems to pull relevant data for predictive analytics and superior financial planning is the next step forward. Machine learning models have made predictions simpler and improved overall effectiveness of business processes. It has brought a deeper understanding of the drivers in your business model and helps to incorporate a driver based forecasting for further granularity.