Challenge

The challenge in the manual account reconciliation process:

- High dependency on spreadsheets, shared files – Creates inconvenience

- High employee interdependence – Confusion; diluted focus on critical tasks

- Long reconciliation cycle – Undue labor and costs

- High human involvement – Error-prone

- Duplicate entries and low process transparency – Inaccurate reporting

Enter RPA

Nalashaa was delegated the job of resolving the reconciliation process by eliminating the loopholes. The team deployed RPA after conducting an elaborate and multilevel analysis of the process, working out the dynamics of the implementation, and creating a process blueprint.

The magic of the bots

Data integration

Bots identify emails containing bank statements, download the attachments, validate their format, and copy the data to an Excel sheet. . The general ledger (and sub-ledgers) is downloaded from the FTP server and the data is scanned and extracted to the same MS Excel file before starting the reconciliation process.

Reconciliation

As configured, RPA bots initiate the reconciliation process as configured. This includes filtration, sorting, and comparison of data from the two files. Botstake appropriate steps in case of exceptions like data in an invalid format, missing data, etc. Another spreadsheet is updated with all the matching results. For transactions that cannot be reconciled, a report is sent to the team for further action.

Report preparation and sharing

Post reconciliation, bots compose an email with a detailed report of the reconciled data. It contains the time of reconciliation, total amount reconciled, number and value of discrepancies, etc. and send it to the stakeholders over emails and notifications. Also attached to the email is the reconciled file with transactions highlighted for easy identification and analysis.

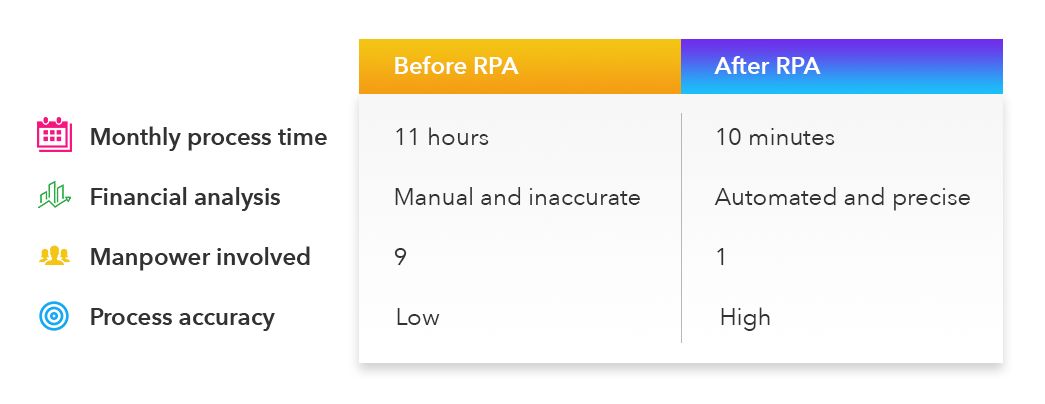

Investment returns

- Accelerated reconciliation process

- Better employee focus on value-adding services

- Error, anomaly, and fraud identification

- Standardized and error-free process

- Elimination of manual reminders

Technology Stack

- UI Path

- Google Tesseract

- .Net

- ML

Let RPA handle your finances

Today, an overwhelming number of businesses are embracing the power of RPA because of the countless possibilities it brings to daily operations. You too can revamp your daily finance operations with the assistance form our RPA experts. A quick chat with us marks the beginning of the process that can help you realize substantial business gains.