Banking and loan disbursement modules for a fast growing mortgage company

Overview

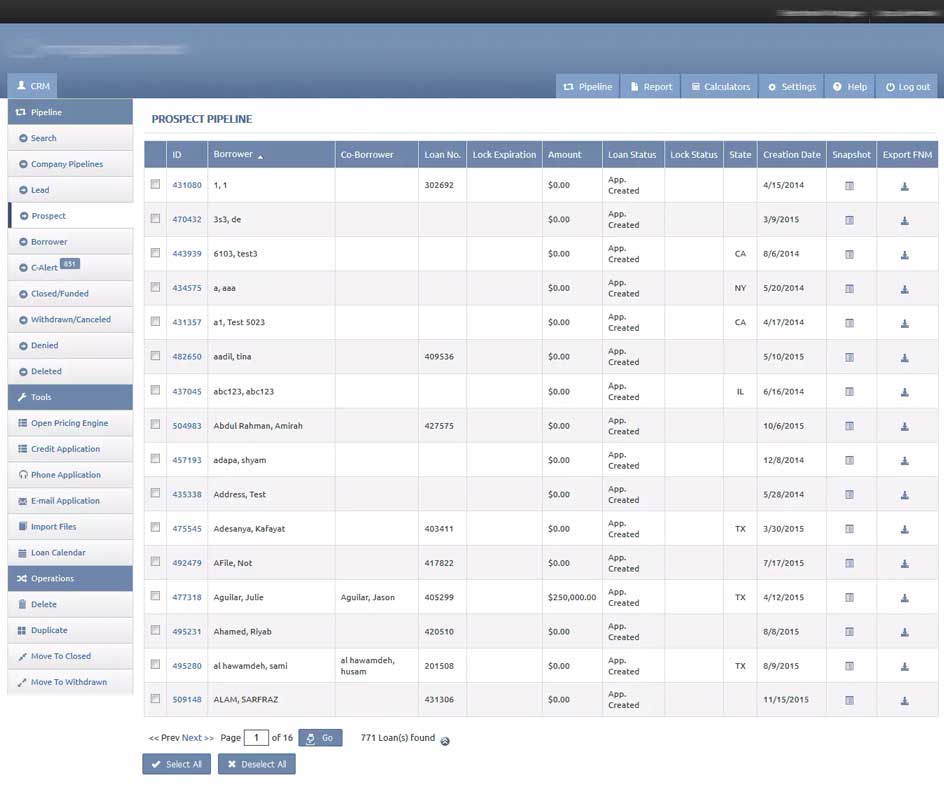

Client is one of the fastest growing mortgage companies in the US with over 45 branches in the US. For faster loan disbursement, the firm needed underwriting, funding and related modules to be technologically advanced.

Technology Stack

- ASP .Net

- Javascript

- jquery

- MS SQL

- SRSS

Client Challenge

Underwriting, Funding and document processing was minimally technology enabled, and a large chunk of the work was manual. These processes need to be changed to ensure faster loan processing with a reduction in manual processes.

Solution

Nalashaa implemented a solution to work in the underwriting, funding, closing, post closing and secondary modules of loan processing. The solution offered helped the customer expand on business and better customer satisfaction and support cycles.