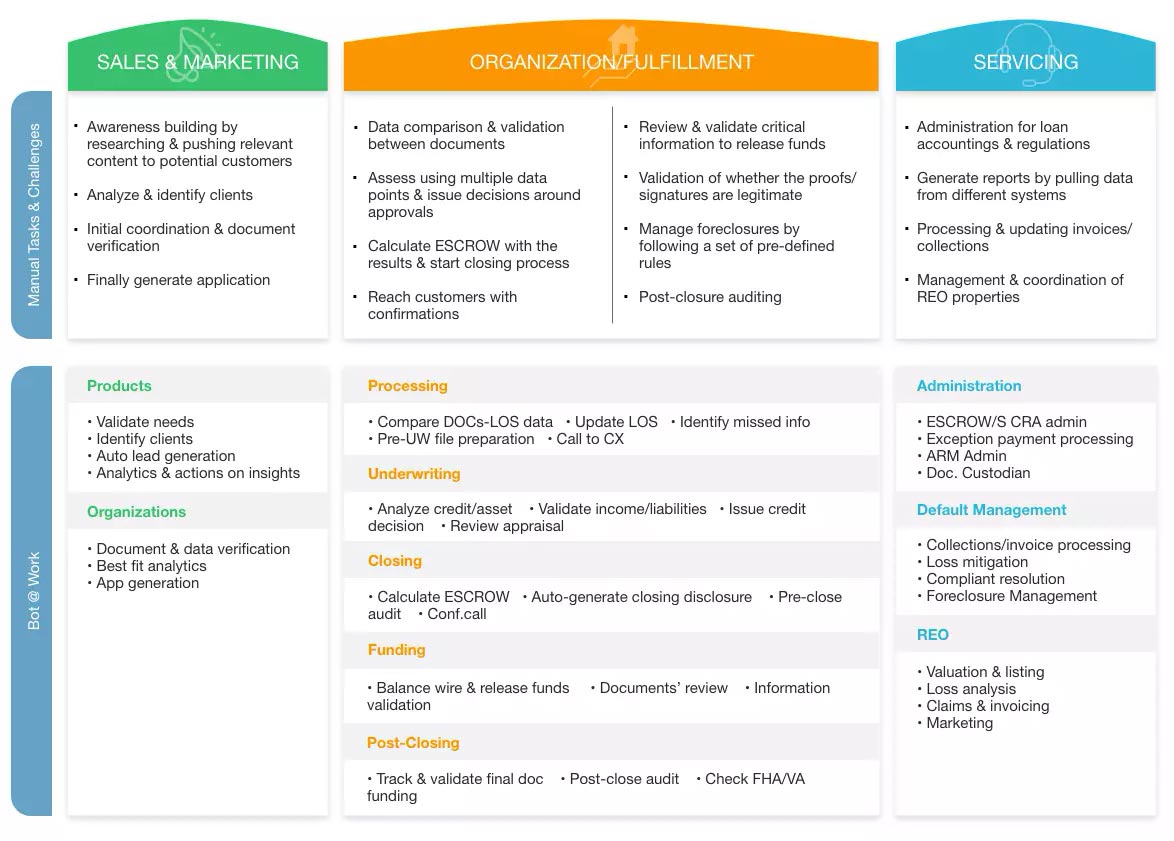

Mortgage process automation services streamline loan processing by automating tasks such as document verification, data entry, and compliance checks. Robotic process automation in lending ensures that repetitive tasks are handled swiftly, enabling staff to focus on customer service and strategic decisions, ultimately improving operational efficiency and reducing costs. Mortgage process automation solutions reduce errors, speed up approvals, and enhance customer experience. RPA in the mortgage industry allows lenders to handle large volumes efficiently while maintaining accuracy.

“Are you going to ride this change or watch the competition do it?”

How Do Mortgage Process Automation Services and Solutions Work?

While ‘RPA’ might sound a little fancy and intimidating at times, its merely substitution of manual labor with intelligent, computer programs. Humanoids as one extreme manifestation of the concept, there are more subtle forms. Most tasks such as loan origination, processing, closures, payment processing, collections etc. are performed by agents using computers. The actions they take (clicks & keystrokes) to initiate or complete these tasks can be performed by programming the same decision making constructs into these computers. Irrespective of the nature of the systems you use (LOS, CRM, custom portals etc.) RPA can operate on top of these to orchestrate the process flows, 24X7 at superhuman speed.

Incoming data

Received from outside or within the organization, in the form of

- Paper

- Spreadsheets/flat files

- Emails, support tickets

- Application notifications

- Database entries

Existing Systems

Triggered based on pre-defined criteria applied to the incoming data

- Content

- Sender, receiver, date

- Business rules etc.

Resultant action

Execution of tasks that need to be performed as part of the business workflow, such as

- Sending emails, notifications, alerts, making calls

- Performing data entry, updates into another system

- Triggering another process

Business Benefits of RPA in Mortgage Industry

No change to underlying systems

End-to-end automation implies speed

Improved consistency at reduced cost

Controlled degree of manual intervention

Digital footprint for feedbacks

How do we help you achieve these?

Blue-printing and candidate process identification

Assessment

Automation of process execution

Implementation

Derive intelligence for decision making

BI & Analytics

Tie learnings back into systems’ decision-making

AI & ML

How to start the journey?

If you're looking to leverage Robotic Process Automation in lending, the form below is a good next step.