Financial services sector has been mostly impervious to radical technical and business model changes. They have been able to maintain a relatively stable but profitable business models over the last few decades. Traditional businesses are now under siege from a whole host of innovators and technology changes that are forcing a re-think on the business models of the traditional financial services sector.

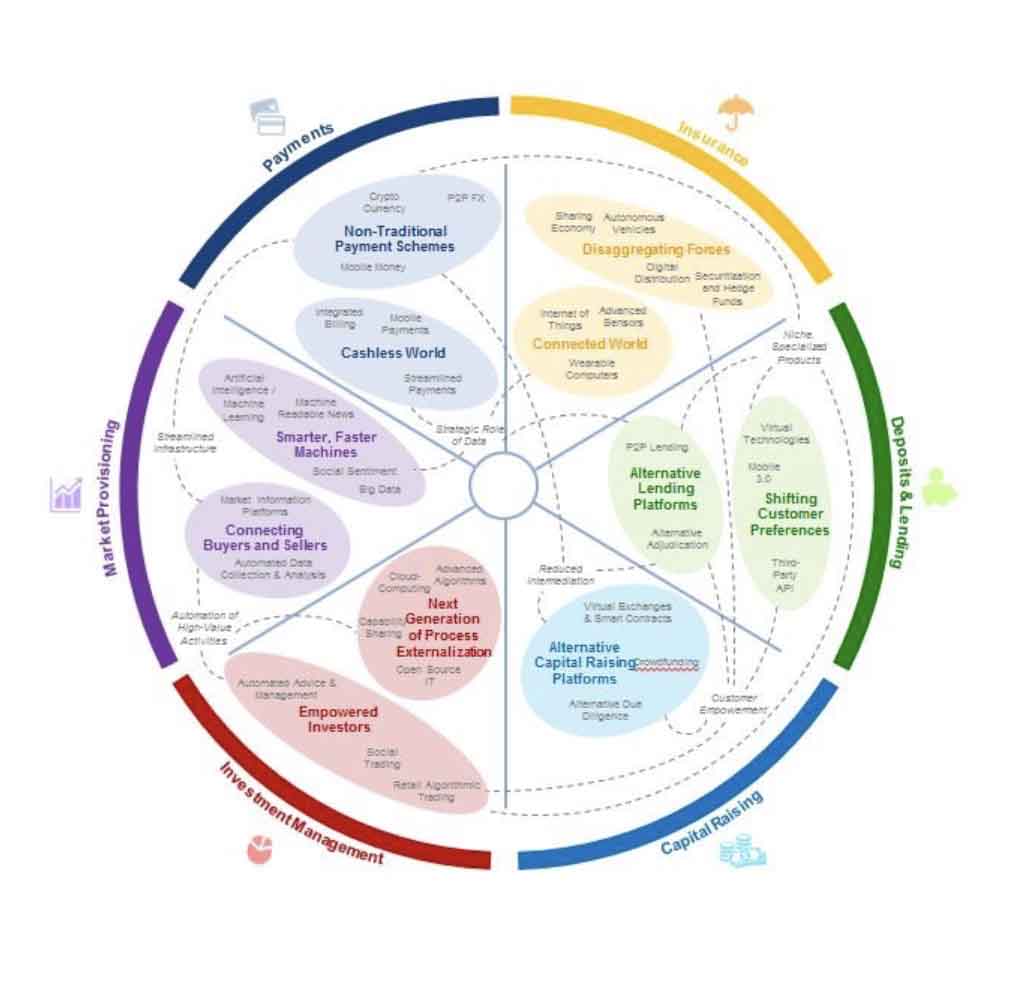

According to the World Economic Forum reports the impact is felt across all sectors of the financial services industry.

Courtesy: WEF Report

According to the findings, today’s innovators are different from earlier disruptors in this sector for the following reasons:

- The lending and mortgage industry is undergoing deep changes with disruptors challenging traditional business models. A new generation of users would prefer to “get a mortgage or refinance their home while standing in line for a cup of coffee”. Shifting customer preferences, regulations and alternative lending platforms are forcing traditional mortgage business models to adopt technology at much faster pace. Inspired by companies like Uber and Airbnb, these innovators have learned to exploit the platform-based capital light models to grow revenues exponentially and keep costs nearly flat. The growth of companies like Prosper and Lending Club are examples of having crossed billion dollars in origination transactions. Without putting their own capital at risk, they have provided a market place for lenders and borrowers to meet and surpass even the best rates. Crowdfunding platforms have had similar disruptive efforts. They have helped start-up many new businesses that would otherwise been not considered for funding by traditional banks and institutions.

- Today’s innovators are targeting the intersection of highly profitable business and customer’s area of frustrations and pain. For example, consider international money transfers. I have personally experienced it first-hand. In the UK, money transfers to india at a high street banks charged from GBP 17 in person and only GBP 12 if completed online. Moreover, it took 4 -5 business days to credit the account in India. Innovation changes the market, however. International money transfer company Money2India.com can complete the transaction at a fraction of the cost (less than GBP 5 per transfer and credited in 1-2 business days). This has become a huge loss of business by high street banks to such innovators and the benefits to the customers.

- The innovators are also using their technical skills to automate manual processes that are currently very resource intensive. “Robo-advisors” such as Wealthfront,? FutureAdvisor and Nutmeg have automated a full suite of wealth management services including asset allocation, investment advice and even complicated tax minimization strategies. Moreover, all these services are offered to customers via an online portal. This allows them to offer services to a whole new groups of customers that were once reserved for the elite. Today, you do not need a six figure asset pool to be eligible for such services. As a result, a whole new class of younger, less wealthy individuals are receiving advice and support.

- The strategic use of data and analytics has been one of the key innovations of new entrants to banking and insurance. Traditionally, bankers would look at credit scores and insurance providers would look at health or driving records. However, as our devices and social lives have become more entwined, innovators are mining the data across devices and social media to provide more customized services. Some innovative insurers are even providing fitness bands to customers. Based on whether you have been hitting the couch or the gym regularly, you have the option of reducing your insurance premiums. These sort of innovations have added a whole new set of customers. With connected cars and more wearables and social connections, customized products will become the norm.

- As part of the growth strategy, these innovators are co-operating with incumbents in some areas and competing in others. They are quick to take advantage of the scale and reach of these companies and for traditional companies, it is an easier channel to new markets. ApplePay, for example, is not competing with Visa and MasterCard but working with them on the payment networks. Same is evident in India with innovators such as paytm and oxigen, who are tying up with traditional network and co-operating as a strategy to increase their reach and growth.

These changes can only prove beneficial to end users in terms of better rates, efficient service and customized attention from the providers.

Companies like Nalashaa are working with mortgage technology companies and mortgage service providers to move up the innovation curve and make a difference to their users and stakeholders. For more details on how we have enabled such transformations in mortgage technology, please feel free to reach out to us and learn how we can help you ride the waves of change.